Valeura Energy (VLE.TO) - Oil & Gas Growth Story At a Steep Discount

This fast-growing upstream company has emerged as a significant player in the Southeast Asian energy landscape. With a remarkable 42% surge in daily production, it remains significantly undervalued.

Summary

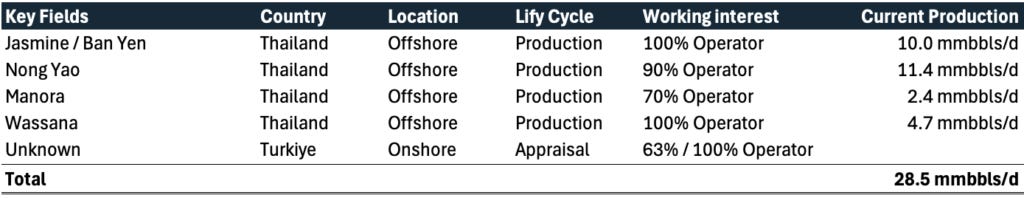

Valeura Energy is a fast-growing upstream Oil & Gas company that became Thailand's second-largest crude oil producer. From the end of 2023 to now, its production grew ~42% from 20.4mmbbls/d to 28.5mmbbls/d.

It continues to expand its portfolio in Southeast Asia, adding ~2x more oil reserves than it is pumping out of the ocean floor. The company is also exploring other opportunities, most notably in Turkey (potentially its first onshore asset).

The business is becoming extremely profitable. We expect it to generate ~ a 28% free cash flow yield for 2024 (~3x from last year's 10%) and grow its clean EPS (adjusted for inflationary adjustment and M&A-related one-offs) 10x to $0.84/share. We are slightly above the consensus of $0.79/share, mainly due to the recent increase in production from the Jasmine field that could not yet be included in analysts' forecasts.

After asset consolidation, the company has $397mm in accumulated tax losses that will offset the existing 50% tax for upstream producers that it is subject to. Although it is hard to say how much of the tax expense will be covered by that benefit yearly, we think it could be substantial at 50-100%. Assuming 50%, the company's tax should decline from 50% to 25% in the 2024E-2030E period.

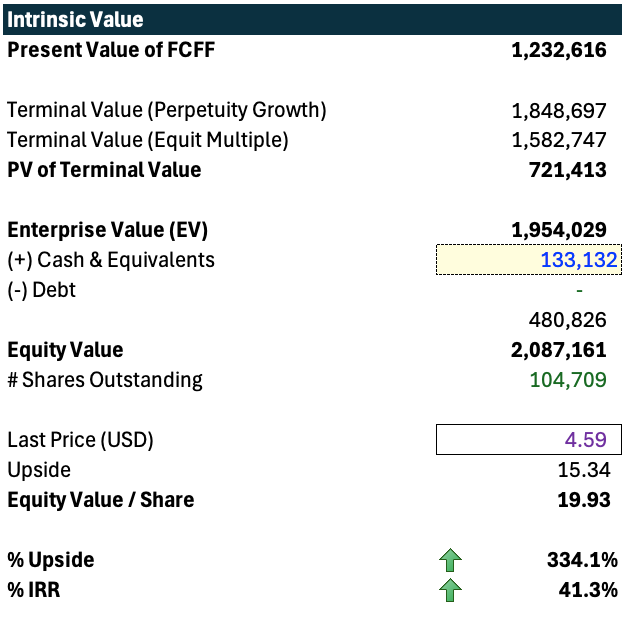

Valeura has no debt and ~$133mm cash compared to mkt. cap of ~480mm.

The company initiated a buyback program for 7.4m shares (~7.1% shares outstanding).

Valeura has a healthy insider ownership at ~ 19%.

The company is operating in an increasingly attractive local environment—it is growing in a declining market with increasingly valuable assets. Thailand's production went from ~275mbbl/d at its peak in 2016 to just ~145mbbl/d now (a 47% decline). Meanwhile, crude oil consumption grew ~2% from 1,197mbbl/d (8x oil production). This, combined with stagnant/slowly growing oil consumption in Thailand, results in a growing reliance on imports, which strengthens Valeura's position.

We believe the main risk is a decline in crude oil prices. However, it is largely mitigated by extended OPEC+ production cuts and flattening the Brent curve. Moreover, due to Valeura’s strong production growth, earnings and cash flow expansion shouldn’t be at risk.

The stock is deeply undervalued at 2024E's 1.7x EV/EBITDA and 3.6x EV/FCF. Compared to its peers’ multiples, Valeura is trading 2.0-2.2x lower, suggesting a significant upside of ~124%.

Moreover, our base and bear case DCF valuation indicates ~334% and ~293% upside, respectively. The kicker? We don't assume any major portfolio expansions but just the maintenance of the existing fields. The only exception is Manora, which we assume will face declining production since 2029, going to zero by the end of 2031.

Download Our Model

Company Overview

Valeura originates as a crude Exploration & Production business from Turkey. Through its two major and accretive acquisitions in 2022 and 2023, the company transformed with a new beginning in Thailand. Its market cap exploded from ~$40mm in mid-2022 through ~$200mm by mid-2023 to ~$480mm now. It continues to grow, with daily production expanding from the end of 2023's ~20.4mmbbl/d to ~28.5mmbbl/d (up ~40%). Despite rapid growth, the company is disciplined with its investments, meeting spending guidelines or undercutting them (H1 2024's Nong Yao field development was completed 25% was under budget, achieving a 60% production jump).

Valeura Energy Fact Sheet

This year, the company merged the production assets, restructuring its organization. Valeura plans to take advantage of the losses existing in the acquired entities. These total ~$397mm that could be subtracted from the taxes in the upcoming years. As the upstream company, Valeura is subject to a substantial income tax of 50% and a small SBR windfall profit tax. Existing tax assets could offset the first. We assume it could cover ~50%, meaning ~25% tax rate for the next 5 years.

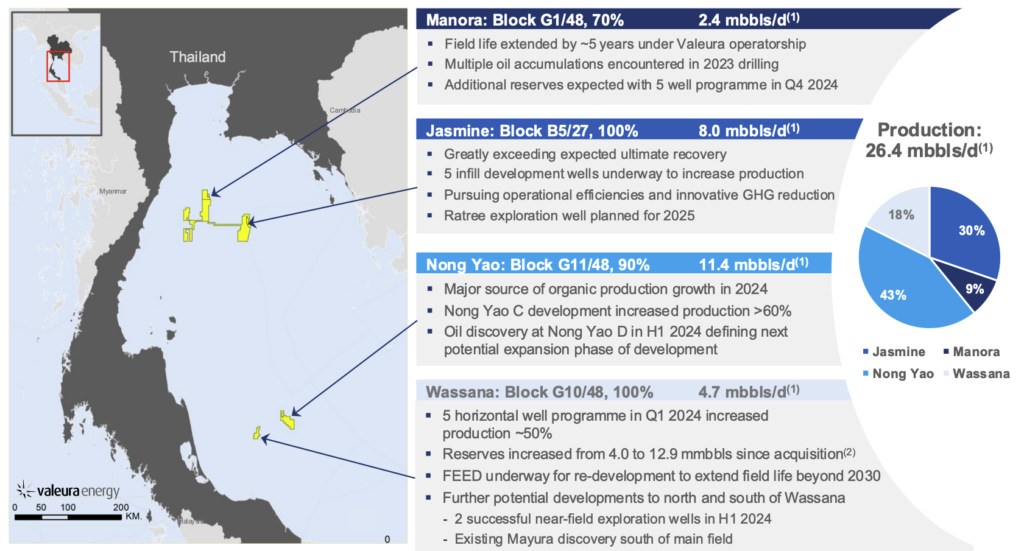

Production Assets Overview

Through acquisitions and redevelopment, as well as further exploration, Valeura built a solid portfolio of four crude oil-producing assets:

Jasmine / Ban Yen (100% working interest)

Production of 10.0 mbbls/d attributable to the company (after completion of an infill drilling campaign, i.e., additional wells were built between existing wells).

Ratree exploration well is planned for 2025.

Nong Yao (90% working interest)

Production of 11.4 mbbls/d attributable to the company.

1H2024 development increased production >60%.

Manora (70% working interest)

Production of 2.4 mbbls/d attributable to the company.

The field is relatively advanced in its lifecycle. 2022 & 2023 infill wells have extended economic life from 2022 to 2027.

Following the Jasmine expansion, the company’s contracted drilling rig has been moved to the Manora field, where it has started operations on a five-well infill drilling program (these could potentially extend asset life further).

Wassana (100% working interest)

5 horizontal well programme in Q1 2024 increased production ~50%

Reserves increased from 4.0 to 12.9 mmbbls since acquisition

Work underway for redevelopment to extend field life beyond 2030

Further potential developments to north and south of Wassana

Fields Overview

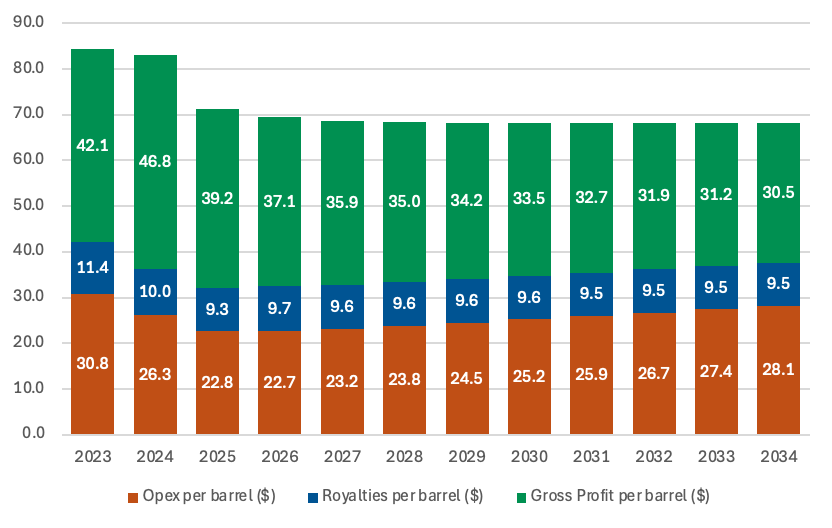

Margins Overview

In 2023, Valeura's operating costs (Opex) were approximately $30.8 per barrel, and royalties were about $11.4 per barrel. With an average realized crude oil price of $84.3, this resulted in a gross profit of roughly $42.1 per barrel, or a 50% margin. Including other revenue sources, the total gross profit margin for 2023 climbed to approximately 59%. Despite declining crude oil prices, Valeura significantly increased its margins through cost optimization and economies of scale.

Based on company guidance and year-to-date performance, we anticipate Opex and royalties for 2024 to be around $26.3 and $10.0 per barrel, respectively. This represents a 14% year-over-year reduction in Opex and a 12% decline in royalties. Assuming a realized crude oil price of $83.0, the gross profit per barrel could reach approximately $46.8, with a 56% margin. This would translate to a 6 pp expansion in the gross profit margin. Incorporating other revenue sources extrapolated for the full year, we expect a 64.5% gross profit margin in 2024, a 5.5 pp year-over-year increase.

Value Creation

in November, Valeura announced a substantial share buyback of 7.4m shares (~7.1% shares outstanding). For us, it means two things. First, The company understands value creation dynamics and chooses the tool that is taxed once, unlike dividends (company's and shareholders' income). Secondly, it is a sign that despite >100% share price appreciation, the intrinsic value of the business is higher.

We note that many businesses, often overvalued, still engage in buybacks. However, they usually use cash terms when defining these programs, dedicating a strict budget. These often are not enough for even a few percent of shares outstanding. In this case, we are faced with a very different nature of the buyback program mentioned in the company announcement:

"Valeura believes that the prevailing market price of the Shares may not, from time to time, reflect the Company’s intrinsic value and future prospects, and that the purchase of Shares represents an appropriate use of the Company’s financial resources to enhance shareholder value." - Valeura Energy

Adding to the buybacks, we are optimistic about the current management's ability to execute. They are experienced professionals who have already proved their abilities by conducting multiple successful acquisitions, field redevelopments, and exploration campaigns, often under budget.

The current CEO, Dr. Sean Guest, is a Ph.D. in Geology and spent the last 30 years in the industry. More importantly, he has already successfully led two Oil&Gas companies - Pexco Energy and Bukit Energy that operated mostly in Asia, Australia & Oceania. Before that, he worked most notably in Shell, where he got his first extensive experience in exploration.

Macro Environment

As an upstream company, Valeura’s performance is largely dependent on the market price of the commodity it sells—crude oil. Two blends work as a benchmark for the company’s realized prices—Dubai and Brent. The latter was historically closer to the average realized prices. When discussing the crude oil price going forward, Brent will be the one we’re referring to.

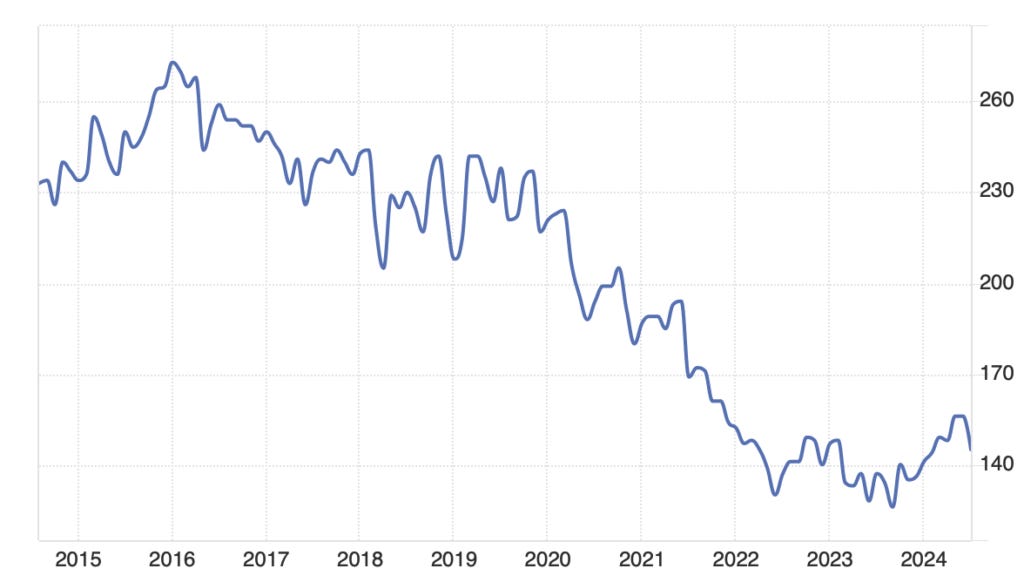

Brent Price ($/bbl)

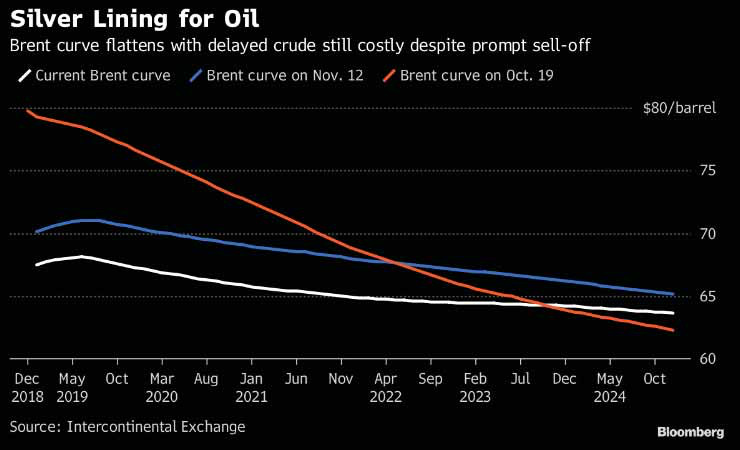

Brent declined from ~$119/bbl at the height of the Energy Crisis in Europe (2022) to just ~$71/bbl (~40% decline). there are multiple reasons but the main ones are a) establishing a new hydrocarbon supply chain in Europe (switch from Russia to the United States and the Middle East) and b) economic tremors in China and other emerging economies. Out of these, the latter remains but the downside is largely mitigated thanks to the following:

In 2022 OPEC+ cut production by ~5.9mmbbls/d (about 5.7% of global demand) to support the crude oil price. These reductions included:

~2.0 mmbbls/d from the whole group

~1.7mmblls/d of the first stage of volunatry cuts from eight countries

~2.2mmbbls/d of the second stage of voluntary cuts from the same members

Last week, the cartel agreed to extend its ~2.0 mmbbls/d and ~1.7 mmbbls/d cuts until the end of 2026. The remaining ~2.2mmbbls/d will be gradually unwinded for 18 months, beginning from April 2025 (until September 2026). The group had previously planned to release these capacities over 12 months but chose a more defensive approach.

The flattening of the Brent curve continues. It signals a limited expected price decline. As a result, the overall expected volatility is also reduced which is a good sign allowing for more business predictability - something incredibly rare for this type of business.

From the company's perspective what also mitigates price risk is a fast-growing production that should allow the company to continue expanding earnings and cash flow, even with limited price declines. In this case, the equity story itself would continue to improve.

Regional Macro

Thailand’s macro environment presents more opportunities than risks for the company. Since 2016, the country’s crude oil production declined from ~275 kbbls/d to just ~145 kbbls/d by the end of 2023 (-47%).

Thailand Crude Oil Production (kbbls/d)

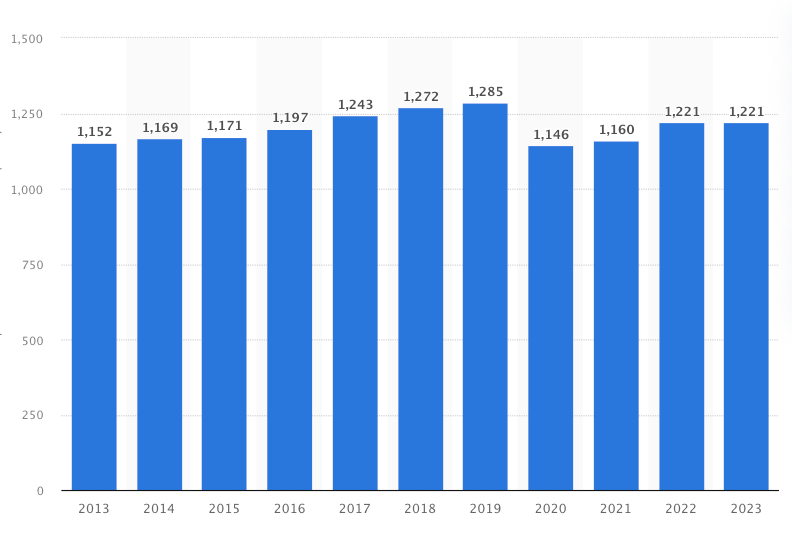

At the same time, Thailand’s crude oil consumption barely grew, rising by 2% from 1,197 kbbls/d to 1,221 last year. In 2016, consumption was ~4.4x bigger than local production, prompting imports of ~922 kbbls/d. Over these few years, mismatch grew almost two times to consumption, outweighing local production by ~8.4x. In 2023, it meant importing a whopping ~1,076 kbbls/d.

Thailand Crude Oil Consumption (kbbls/d)

This drastic change made local producers even more valuable, primarily due to the lower cost of transport. That is why we think Valeura’s production will have fertile ground in Thailand’s growing economy.

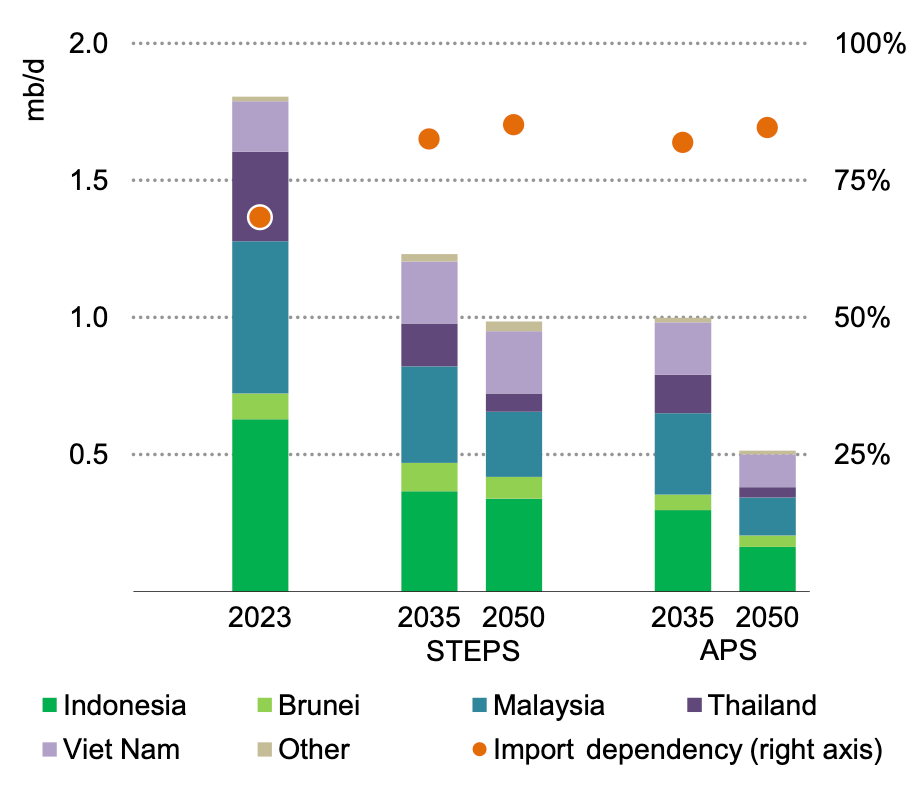

Even if the company were to expand and sell more products outside of other Asian economies, it is expected to find similarly favorable dynamics. According to the IEA report “Southeast Asia Energy Outlook 2024,” import dependency could grow from 2023’s ~66% to 2035’s ~81% for the region (for both projection scenarios):

The Stated Policies Scenario (STEPS) assumes that national energy and climate targets are not fully met i.e. decarbonization and diversification of energy sources take longer than expected (the more probable scenario).

The Announced Pledges Scenario (APS) assumes that all the national energy and climate targets made by governments are met in full and on time, including long-term net zero goals (the less probable scenario).

Changes in oil supply by country and scenario (mmbbls/d)

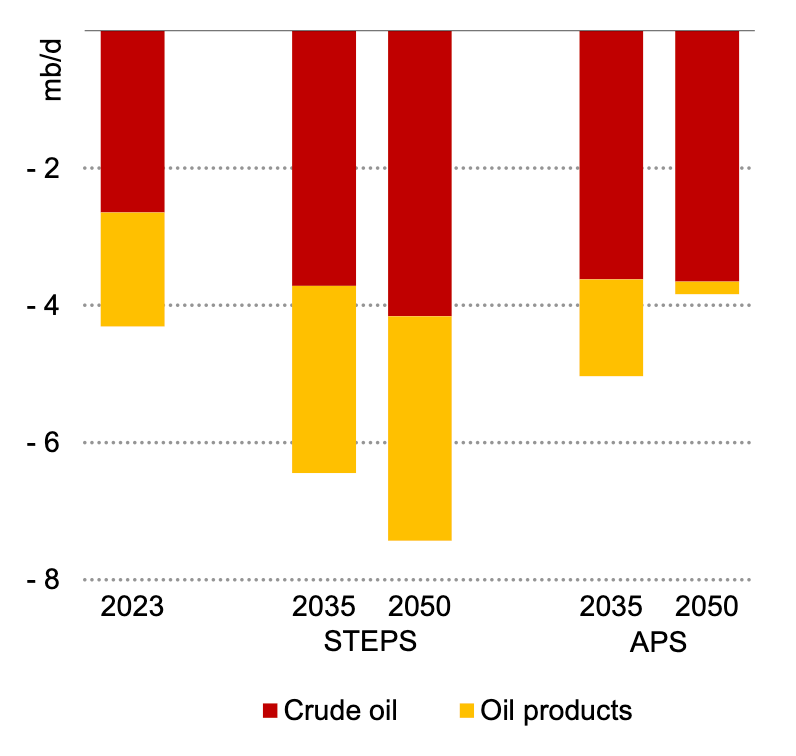

In a more probable STEPS scenario, IEA expects that this growing dependency on production from outside of Southeast Asia will lead to crude oil imports growing from ~2.3 mmbbls/d in 2023 to ~3.8 mmbbls/d by 2035. The trend is expected to continue after 2035 at a slower rate til 2050, requiring ~4 mmbbls/d worth of imports.

Change in net trade by type and scenario (mmbbls/d)

Considering the company’s 2x Reserve Replacement Ratio, we think the business is on track to go from the second largest to the largest crude oil producer in Thailand in the next few years. Additionally, It can become one of the biggest in Southeast Asia benefiting from manufacturing buildup in the region. We also believe, that growing operations could allow for more efficiency in asset acquisitions, and drilling, and, potentially grow business profitability.

DCF Valuation

To value the business we used Discounted Cash Flow model and analyzed LTM and forward multiples. We think these tools should allow us to roughly estimate the intrinsic value of the company.

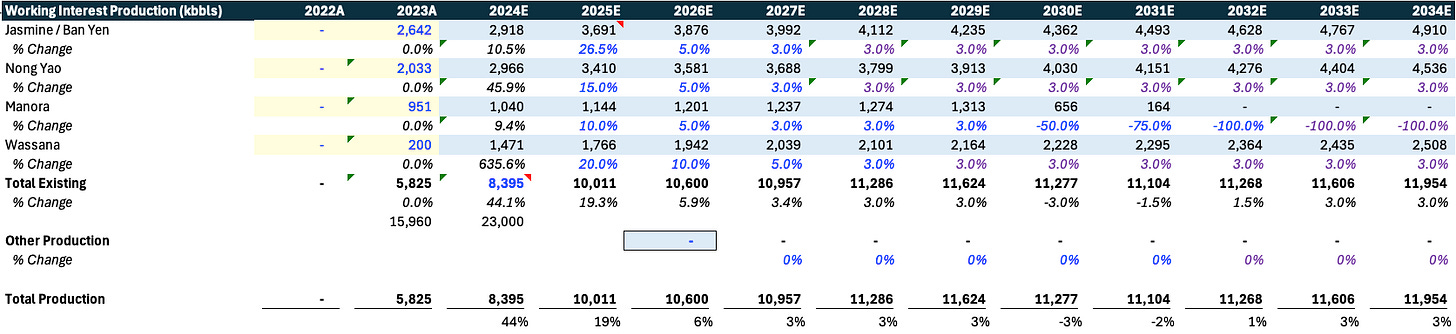

Production Forecast

We build the model bottom-up based on the Management Analysis Reports available. To estimate revenue we build a production forecast for each field. Our main assumptions are the following:

Jasmine / Ban Yen would deliver 1% more than the current daily production throughout 2025, resulting in a 26.5% production change YoY. For 2026 we assume a 5% YoY change in yearly output and in later years 3%.

Nong Yao would be expanded to deliver 15% more output next year. For 2026 we expect 5% production change and in the next years 3%.

Manora field is relatively advanced in its lifecycle. 2022 & 2023 infill wells have extended economic life from 2022 to 2027. Now it is undergoing similar redevelopment. We assume limited success from that investment with full-capacity operations extended to 2029. For 2025, we assume a 10% production increase. For 2026 we assume 5% and for the 2027-2029 period, 3% change in the asset output. After 2029 we expect production to decline and to reach zero by the end of 2032.

Wassana asset is a fast-growing field with major reserve discoveries. Currently, there’s work underway for redevelopment to extend Its life beyond 2030. There could be further potential developments to the north and south of Wassana. The investment outcome is hard to predict and we prefer to stress test our model under a fairly conservative scenario so we assume ~20%, 10%, and 5% production change for 2025, 2026, and 2027, respectively. From 2028 on we incorporate a 3% growth factor.

Other Assets are not assumed. It effectively means we don’t include any potential production from Turkey or any acquisitions. Overall, we think this is very unlikely based on the growth strategy of the company and its history. However instead of guessing production additions we prefer to leave them at zero and judge the base case as fairly defensive with potential upside.

Production Forecast (kbbl/y)

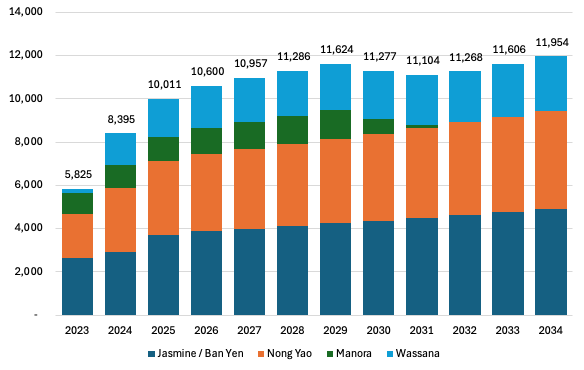

Yearly Production Breakdown (kbbls/y)

To forecast Valeura’s revenue we assume a $83/bbl realized oil price for 2024 vs YTD realized price of ~$84/bbl. For the rest of the projection period, we use Brent futures. These prices multiplied by our forecasted production make our revenue.

Margin Forecast

In our model, we assumed contracting margins primarily driven by declining crude oil prices and increasing operating expenses (OPEX) beginning next year. Royalties are projected to grow from 12% in 2024 to 14% by 2026, stabilizing thereafter. As a result, we forecast a margin decline from ~$39.2 per barrel in 2025 to ~$30.5 per barrel in the terminal year. This translates to a decrease in gross profit margins from 56.5% in 2024 to 46.6% in the terminal year.

Gross Profit Per Barrel Breakdown ($)

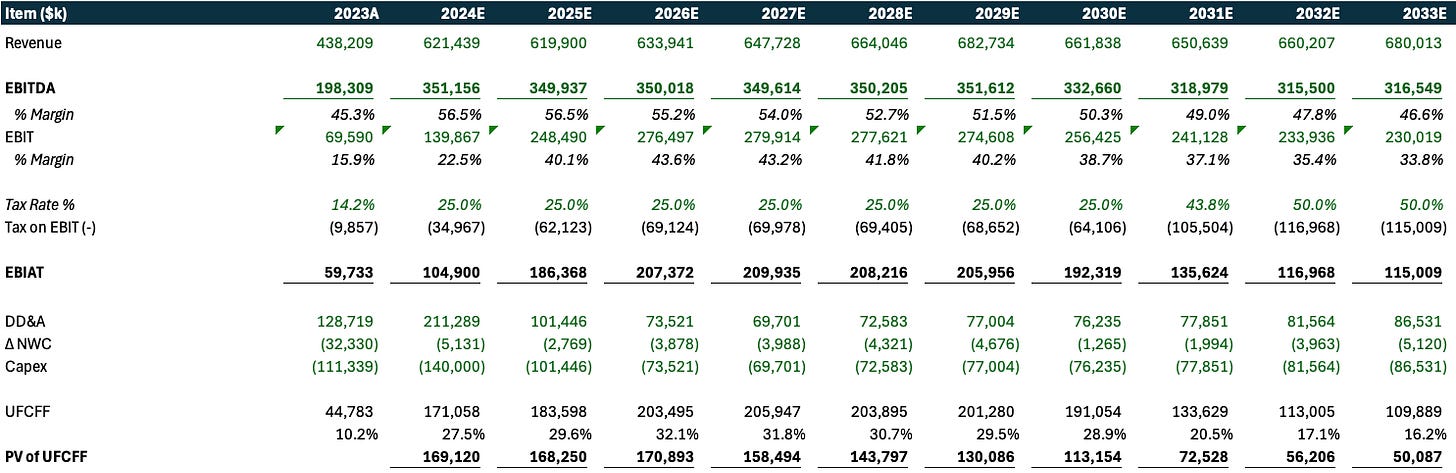

Capex Forecast

For growth stories like Valeura, capital expenditures are a crucial cost of doing business. Based on the 2024 guidance, we estimated capex per bbl of new production at ~$43.6 for the year. However new production, primarily from Wassana and Jasmine, is not fully included in the full-year numbers (they were completed only later in 2024). That’s why we adjusted it by 15% for 2025, resulting in ~$37.1 capex per barrel. From 2026 onwards, our capex per barrel grows at 3% YoY.

By combining our declining production additions with forecasted cost per bbl, we estimate ~$101mm capex next year, declining to $70mm by the end of 2027. Then it gradually grows to $92mm in terminal year.

Capex Breakdown ($mm)

Results

We assume declining Gross Profit Margins coming down from 56.5% in 2024E to 46.6% in the terminal year. However, due to the fluctuating capex spending Free Cash Flow margin is more volatile. It intiially grows from 2024’s 27.5% to 32.1% in 2026 and then declines to just 16.2% in the terminal year.

Free Cash Flows ($k)

For exit multiple we assumed 5x EV/EBITDA, in line with the upstream businesses. For discounting cash flows we used the WACC of 9.12%. Based on these metrics we arrived at the Enterprise Value of ~$2.0bn. After adding ~$133.1mm of cash on the books and dividing it by the number of shares outstanding we arrive at $19.95/share target price. The current share price of $4.59 (USD) implies ~334% upside…

DCF Summary ($k)

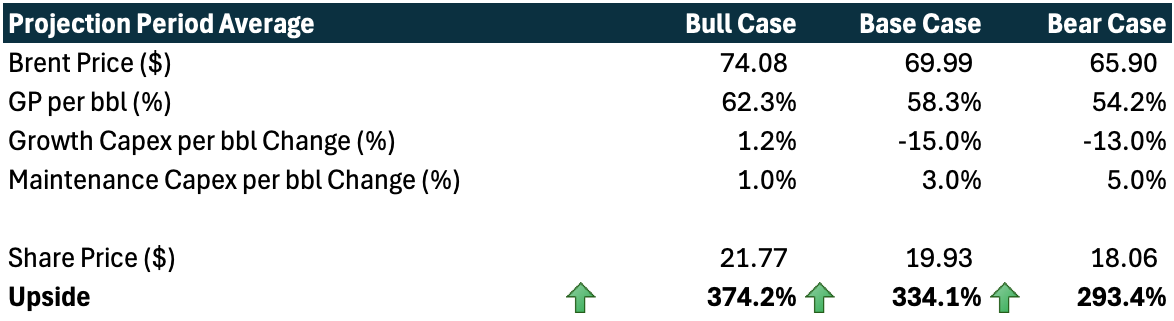

Scenario Analysis

To flex our assumptions we run sensitivity analysis. We prepared Bull and Bear cases by tweaking key metrics in the projection period. These include:

Avg. brent price

Avg. GP margin per bbl

Avg. growth capex per bbl change

Avg. maintenance capex per bbl change

With these assumptions we were able to estimate Valeura’s share price under different scenarios. It ranged from $18.06 in bear case to $21.77 in our bull case. This range could be thought of as our intrinsic value estimate.

Mutliples

Siimmilarly to our DCF, multiples scream “undervalued!” as the company is trading at 2024E's 1.7x EV/EBITDA, 3.6x EV/FCF and 2.8x P/FCF. For comparison, we can use Asia and Australia focused E&P players like Beach Energy and Woodside Energy.

Our preffered multiple is EV/EBITDA becuase it is the most popular and universally applied. Beach Energy and Woodside Energy have NTM EV/EBITDA of 3.4x and 3.8x, respecitvely. These mean that Valeura is 2.0x cheaper than Beach Energy and 2.2x cheaper than Woodside Energy. Market cap weighted average EV/EBITDA multiple is 3.8x (due to relatively large size of Woodside Energy), suggesting ~124% upside.

We think this undervaluation combined with DCF upsdie is exceptional and could outweigh potential risks :)

Key Risks:

Crude oil prices decline and volatility

Capex inflation

Declining Reserves Replacement Ratio

Thank you for spending time on our lenghty deep dive analysis. Let us know what do you think about this company in comments.

Disclaimer

The information contained on this website is not and should not be construed as investment advice and does not purport to be and does not express any opinion as to the price at which the securities of any company may trade at any time. The information and opinions provided herein should not be taken as specific advice on the merits of any investment decision. Investors should make their own decisions regarding the prospects of any company discussed herein based on such investors’ own review of publicly available information and should not rely on the information contained herein.

The information contained on this website has been prepared based on publicly available information and proprietary research. The author does not guarantee the accuracy or completeness of the information provided in this document. All statements and expressions herein are the sole opinion of the author and are subject to change without notice.

Any projections, market outlooks or estimates herein are forward looking statements and are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. Except where otherwise indicated, the information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials.

The author, the author’s affiliates, and clients of the author’s affiliates may currently have long or short positions in the securities of certain of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). to the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the author nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. In addition, nothing presented herein shall constitute an offer to sell or the solicitation of any offer to buy any security.

External links, if any, may redirect you to a privately-owned web page or site (“site”) created, operated, and maintained by a third party, which may not be affiliated with Alpha Ark. The views and opinions expressed on the site, other than those presented by Alpha Ark, are solely those of the author of the site and should not be attributed to Alpha Ark. We have not verified the information and opinions found on the site, nor do we make any representations as to its accuracy and completeness as to the third-party information. Further, Alpha Ark does not endorse any of the third-party’s products and services or its privacy and security policies, which may differ from ours. We recommend that you review the third-party’s policies, terms, and conditions to fully understand what information may be collected and maintained as a result of your visit to this website.

Great analysis! Some assumptions may be optimistic, but overall, this is a great buy! Do you plan on updating it after the guidance?

Your capex and production forecasts are waaaaay off. Not to mention other aspects you got wrong.