Superior Industries (SUP) - 13x Turnaround Play

Market Leader Turning Cash Flow Positive: Attractive Risk-Reward

Summary

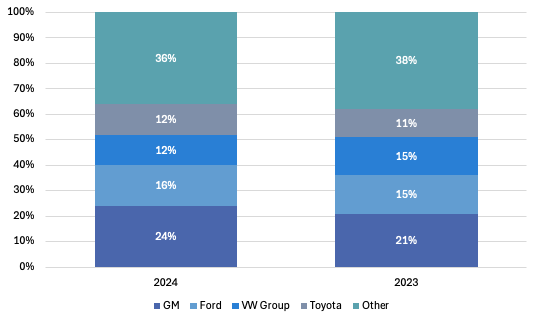

Superior is one of the world’s largest manufacturers of lightweight aluminum wheels, producing nearly 14mm units per year. Its largest customers include General Motors (24% of revenue), Ford (16%), Volkswagen Group (12%), and Toyota (12%), with the remainder coming from companies such as BMW, Honda, Mercedes, Stellantis, and others.

The automotive industry has experienced significant volatility in recent years. It was nearly brought to a halt during the COVID outbreak, followed by a demand peak just 1-2 years later. Now it is again facing a bear market and keeps on struggling with the consumer demand. This decline, coupled with high debt from the Uniwheel acquisition, rising interest rates, and looming tariff risks, has led to a substantial drop in Superior Industries' stock price. Nevertheless, with recent cost-cutting measures, the relocation of European operations to Poland, and a potentially net positive impact of tariffs, the company is well positioned to return to profitability by mid-2025.

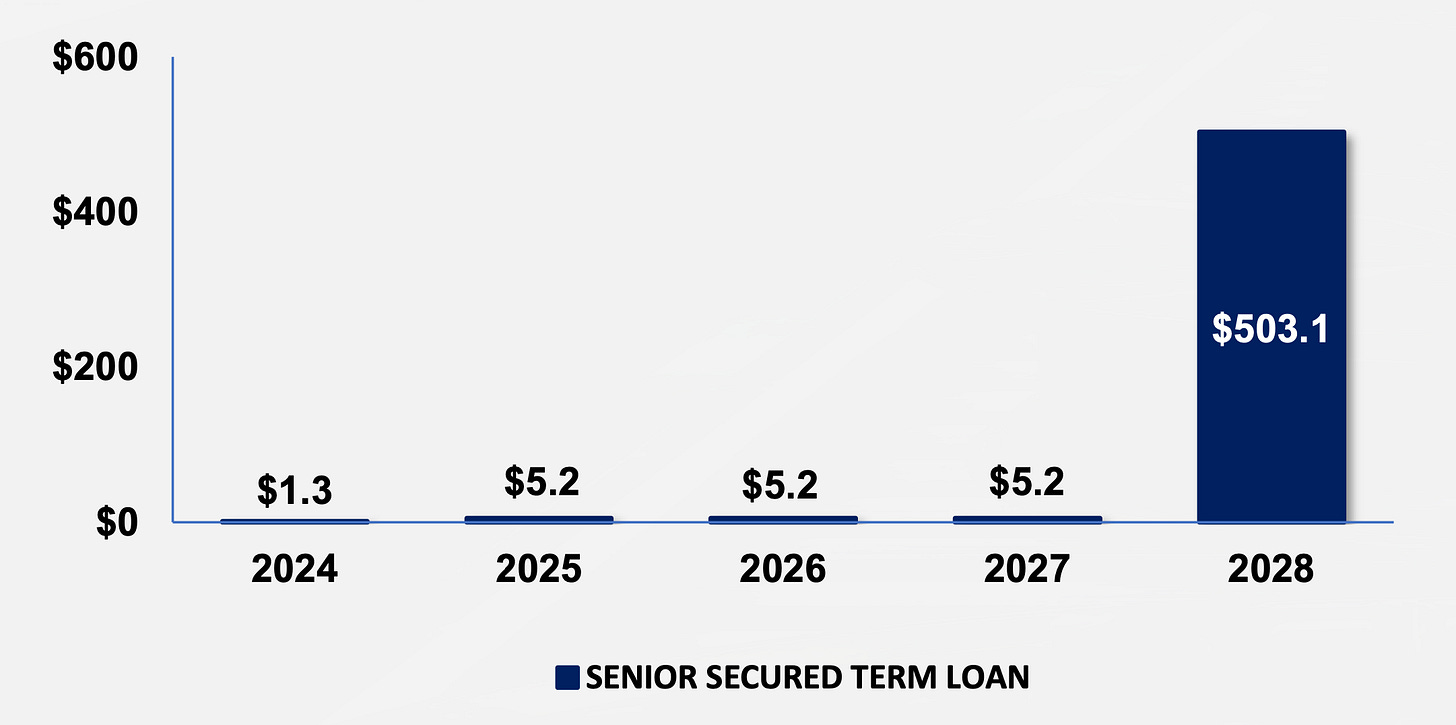

Superior Industries carries a substantial debt load of $483mm, primarily due by 4Q 2028, with an interest rate of over 12%. Additionally, it has $300mm in preferred stock with interest rates ranging from 4.5% to 9%, which will become repayable in September 2025.

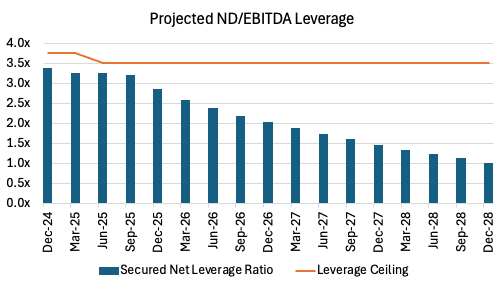

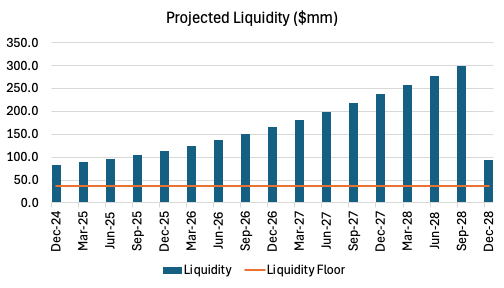

This debt is weighted against an adjusted EBITDA of $146mm, resulting in a Net Debt / EBITDA of 3.4x. The company has a debt ceiling of 3.75x ND/EBITDA until 1Q 2025, after which it drops to 3.5x. It also has a liquidity covenant of $37.5mm, which is currently met threefold.

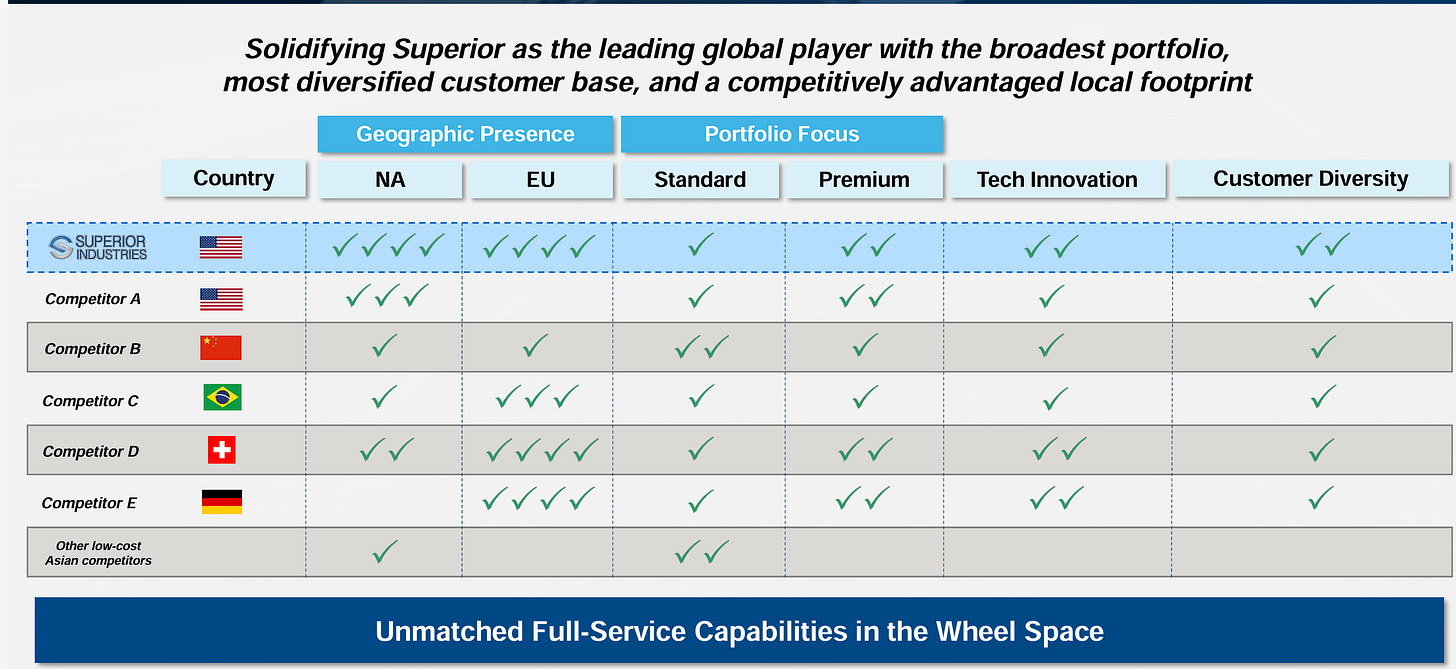

By relocating production to lower-cost regions such as Mexico and Poland, the company can effectively compete against more expensive local players. Additionally, Chinese and Moroccan competitors are facing increasing tariffs from the EU and Mexico, which further strengthens Superior Industries' position.

The stock market has exaggerated the impact of U.S. tariffs. The assumption that these would significantly disrupt the company's Mexico operations were simply incorrect. Superior has revealed that less than 25% of its production in Mexico is affected by the tariffs, as clients typically pick up their orders and assemble cars in Mexico instead of the U.S. Therefore, rather than suffering due to the recent tariffs, Superior Industries may actually benefit from diminished competition from China and Morocco.

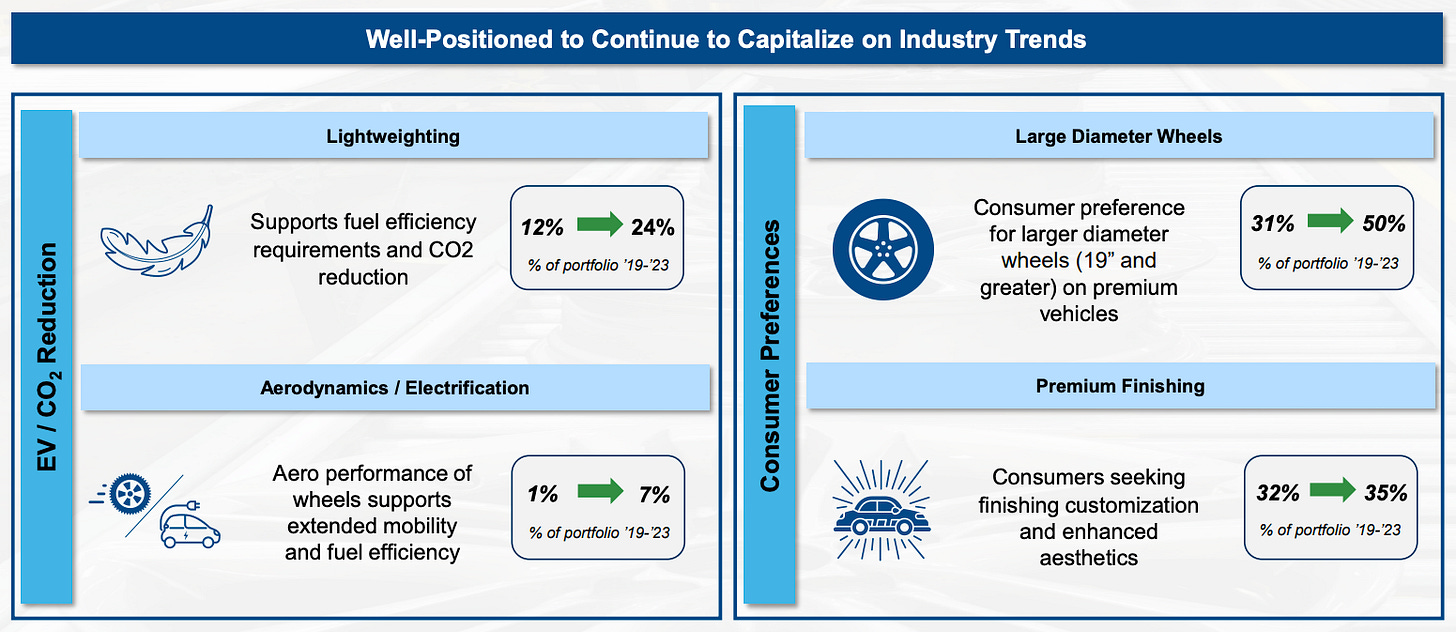

Since 2019, the value-added sales (revenue - aluminum costs) per wheel have increased by 34%, enhancing the company's core profitability. This growth has been partly driven by larger and more premium wheels, as well as high-end electric vehicle wheels that require more integrated production and trust of the premium clients like Mercedes and Lucid.

However, the total number of units produced has declined from approximately 19mm in 2019 to around 14mm in 2024. This decrease is primarily due to lower-end production being pushed out by competitive pressures from Asia, which offers narrower profit margins. Nonetheless, nearly all medium- and high-end market players are now customers of Superior, recognizing it as a preferred and reliable alternative to Chinese manufacturers.

Currently, Superior is operating below capacity, and production volumes are expected to rise with additional contracts planned for 2025. We anticipate continued growth, estimating that by 2028 the company will achieve an EBITDA of approximately $249mm, with $289mm in debt and roughly $392mm in preferred stock remaining.

The company is currently trading at attractive ~5.6x 2025 EV/EBITDA and 4.5x 2026 EV/EBITDA and turned cash flow positive last quarter.

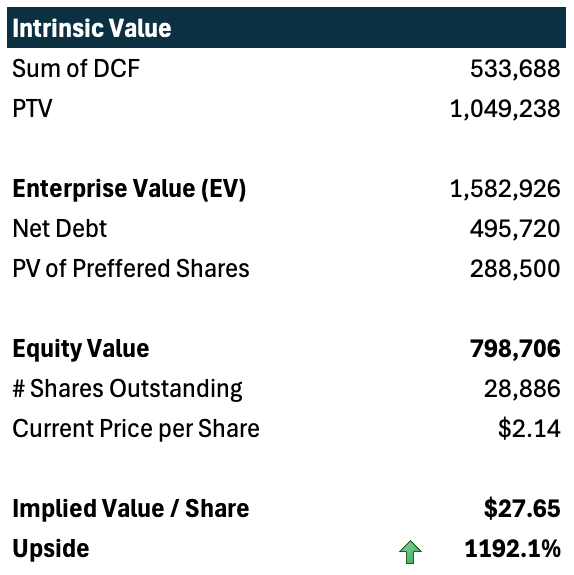

We value the company using the target multiple and discounted cash flow (DCF) model. Using a realistic 6x EV/EBITDA multiple on 2028 EBITDA yields an EV estimate of $1.5bn and a common shareholders' equity value of $0.9bn. This indicates potential upside of ~13x, with a target price of $29.91/share by the end of 2028 (366% IRR). Meanwhile our DCF yields a similar results while based on conservative assumptions. It implies $27.54/share price target at ~12x upside.

Overall we see Superior as a downbeat stock that despite commoditized industry and potential bankruptcy risks has a tremendous upside potential that makes its risk/reward great. We believe even small exposure to this name could yield a very attractive return for the whole portfolio.

Download Our Model

Business Overview

Superior Industries International (SUP) is one of the world’s largest suppliers of lightweight aluminum wheels, with a production output of circa 14mm units anticipated in 2024. Its customer base includes a wide range of automotive manufacturers, such as BMW, Ford, General Motors, Honda, Mazda, Mercedes-Benz Group, Renault, Stellantis, Toyota, VW Group, and many others. SUP primarily serves two segments of the automotive industry: Electric Vehicles (EVs) and Internal Combustion Engine (ICE) vehicles.

The four largest customers of SUP account for 66% of its revenue: General Motors contributes 24%, Ford 18%, Volkswagen Group 12%, and Toyota 12%, with other customers making up the remaining 36% of Revenue. The remainder is composed mostly of BMW, Honda, Mercedes, and Stellantis.

In 2024, North America accounted for ~56% of SUP's value-added sales, with the rest is generated in Europe. Value-added sales represent net sales adjusted for the cost of aluminum, which is passed through to customers.

SUP manufactures ~14mm units per year, predominantly selling in the North American and Western & Central European markets. According to IHS, last year, there were 29.8mm cars produced in these regions, resulting in approximately 119.2mm wheels sold (4x). Of these, around 55% are aluminum wheels, equating to roughly 65.6mm units. This indicates that SUP owns ~45% of the lightweight wheel market in North America and Western & Central Europe. While these figures may seem impressive, it’s important to note that the market is highly commoditized and has been historically highly cyclical.

The Bitter Fruit of Volatile Macro

The company's challenges began in 2017 when it acquired Uniwheels, the third-largest supplier of lightweight wheels to the European automotive market, for $712mm. This transformative acquisition positioned Superior Industries as a market leader not only in North America but also in Europe and seemed like a good move.

However, It was primarily financed through debt and preferred equity, resulting in a complicated financing structure and high leverage. Following the merger, the business underperformed and integration was slow, leading to escalating problems.

When the pandemic hit, the decline in volumes had a severe impact on this over-leveraged business, causing revenues to plummet. The decline in profits was only exacerbated by interest payments.

After a brief post-pandemic recovery, macroeconomic conditions became increasingly unfavorable, and over the last two years, the balance sheet has further deteriorated. Since 2017, it's fair to say that Superior Industries has been a rollercoaster ride for its shareholders, with constant ups and downs. However, there is hope...

To rescue itself from the brink of collapse and cut costs, the company has been relocating its German operations to Poland, with the full impact of this expected to be realized by 2025. It has also introduced an extensive cost-cutting program, and we are already seeing improvements.

Since the implementation of these measures, Superior Industries has been gradually increasing its profitability each quarter, improving from a loss of -$1.50 EPS in 1Q 2024 to -$0.70 EPS in 4Q 2024. We expect this trend to continue, with EPS turning positive by 2Q 2025 and reaching $0.20-$0.30 per share in the fourth quarter. We will delve more into the turnaround prospects later in the article.

Tariff Risk Overblown by the Market

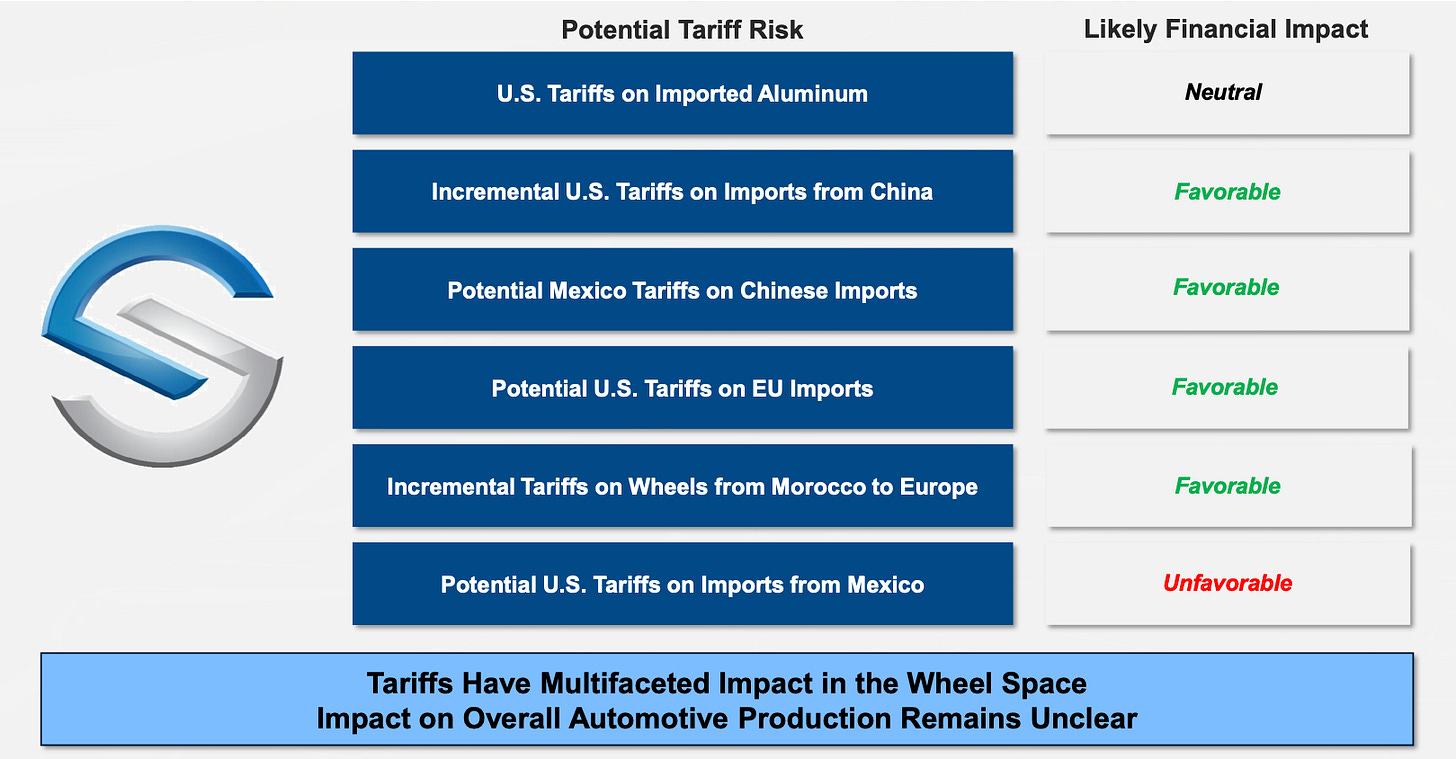

Tariffs have become a hot topic since the US election. They can both benefit and pose risks to international companies like Superior. In this case, they were seen as a negative Concerned investors have driven the stock price down since 2H 2024. However, we believe this reaction is completely out of proportion, as Superior should rather gain from most of the tariffs losing on US one but less than was initially expected. These are the major trade restrictions imposed or pending:

Increased EU tariffs on Chinese wheels from Morocco (net positive) - EU Commission plans on introducing additional tariff on aluminum wheels from China imported through Morocco effectively increasing it from over 22% to almost 50%. According to the management this should make Poland’s production even more attractive for OEMs since China and Morocco are the main exporters of aluminum wheels to the EU.

Increased US tariffs on China (net positive) - in North America, 50% of wheels are imported from China, which currently faces a tariff of about 45% vs 25% previously. If these were to grow further, it would provide Superior with only additional opportunity to take NA sales from China

Potential 25% tariffs on Chinese imports to Mexico (net positive) - although unlikely if implemented, this may positively affect Superior through limiting Chinese imports to the Mexico-based car factories.

US Tariffs on imports from Mexico (net negative) - 25% tariffs on Mexico imports could potentially impact some of the Superior’s wheels directly delivered to the US. However these compose less than 25% of the total Mexico production and the impact on Superior is rather overblown. It was visible during the last earnings call when the management explained impact of the tariffs and the stock jumped 28% in a day, although it could also be the strong results that had some impact.

EU tariffs on US imports and vice versa (net positive) - any tariffs on EU or US imports implemented from the other side would damage the value preposition of localized wheel manufacturers and benefit diversified producers like Superior that can produce locally and omit paying a tariff.

Car Wheel Macro Improving

Automotive is currently facing significant challenges, including high dealer inventories, issues with vehicle affordability due to relatively high interest rates, and shutdowns by key customers, particularly Volkswagen. Since nearly all of Superior's sales are to major car manufacturers, the company is heavily reliant on the overall car market.

Car sales have been relatively low in both the US and EU, resulting in declining sales for Superior. However, we anticipate a reversal of this trend in the next 2 years as mentioned din our General Motors writeup:

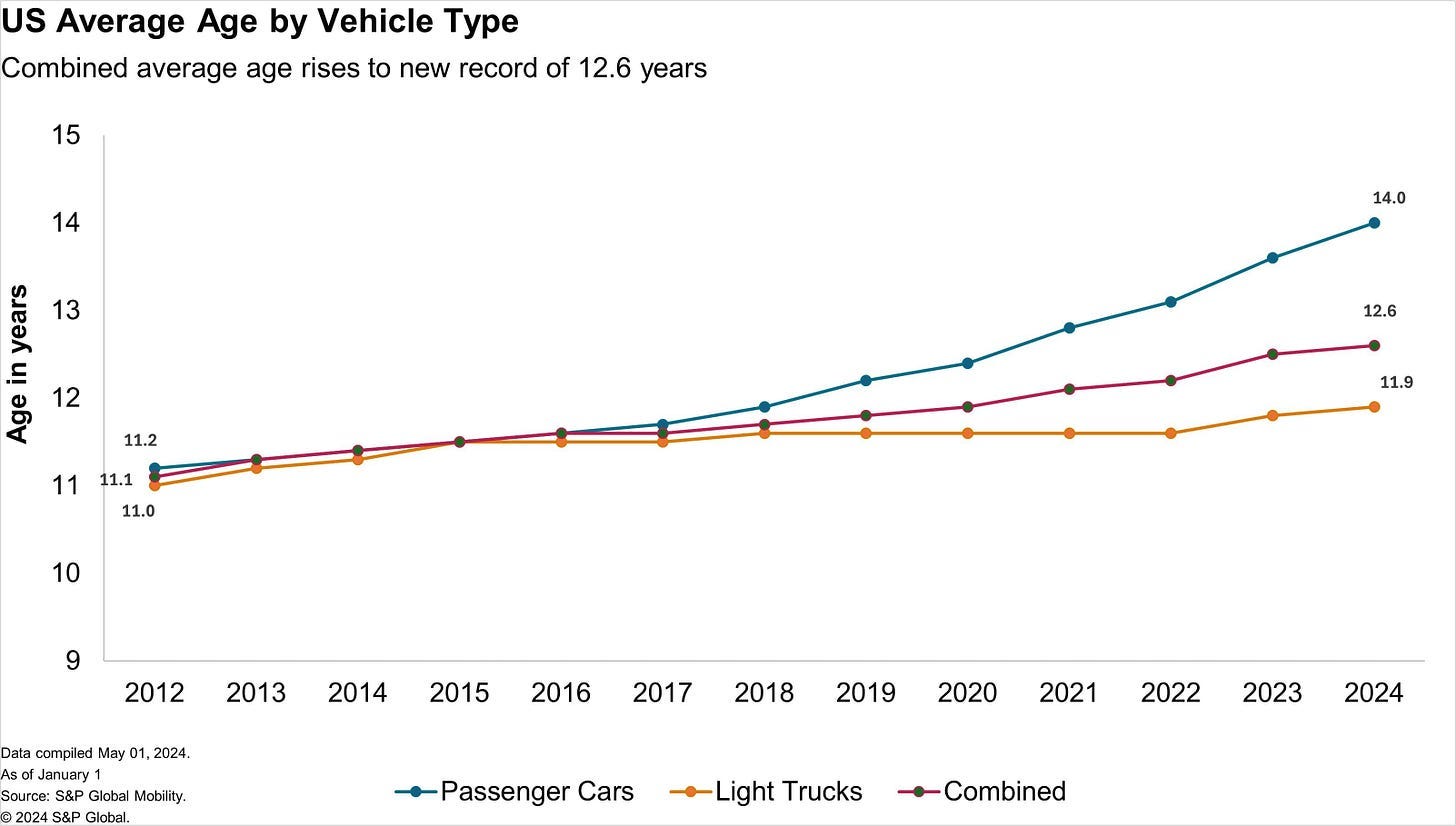

Main reasons for this are due to decreasing interest rates and quickly aging vehicle fleet. For example the average car in the US was 11-12 years old between 2012 and 2020. However after the Covid Average age started growing rapidly and now approaches 13 years.

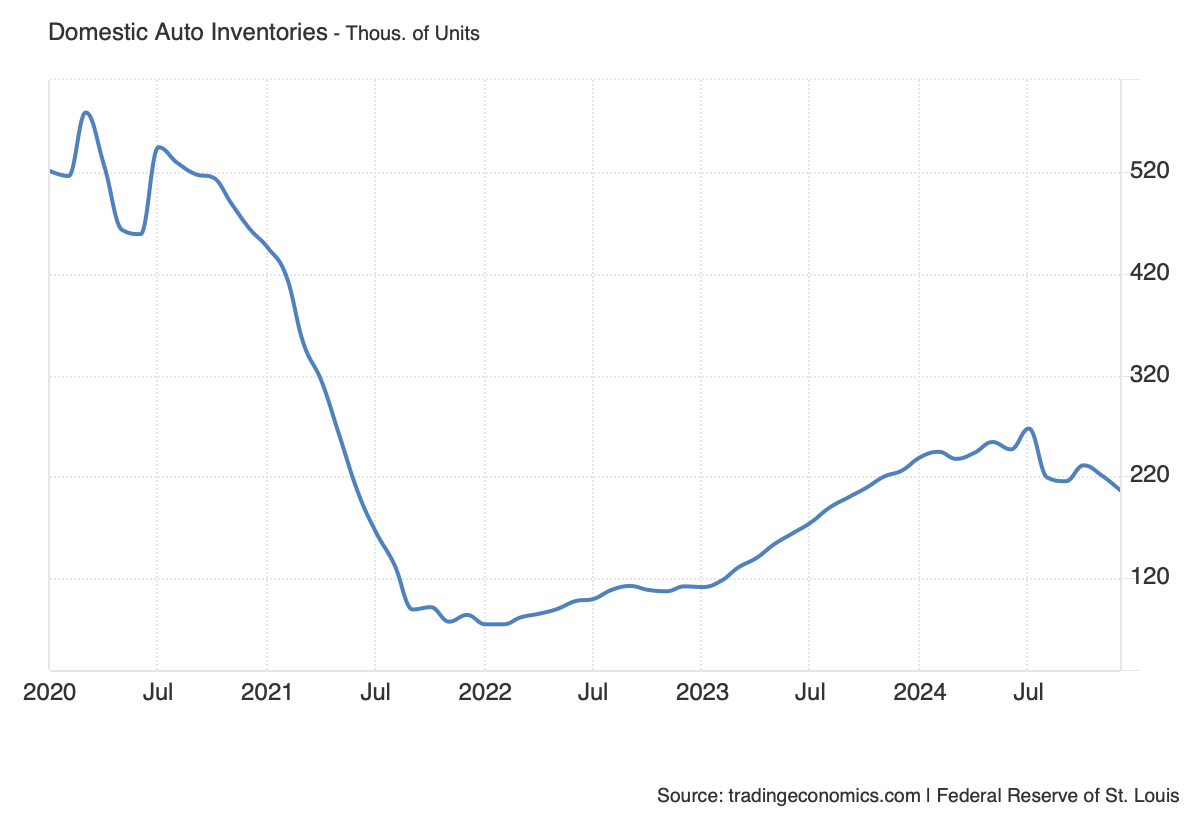

The US car inventory which has grown since late 2021 is now dropping fast and should result in a growing order book for late 2025 and 2026.

That said, IHS forecasts predict further 4% decline this year , but this is already a smaller correction than last year and we think that depending on overall economic situation, the actual sales drop could be even less than that.

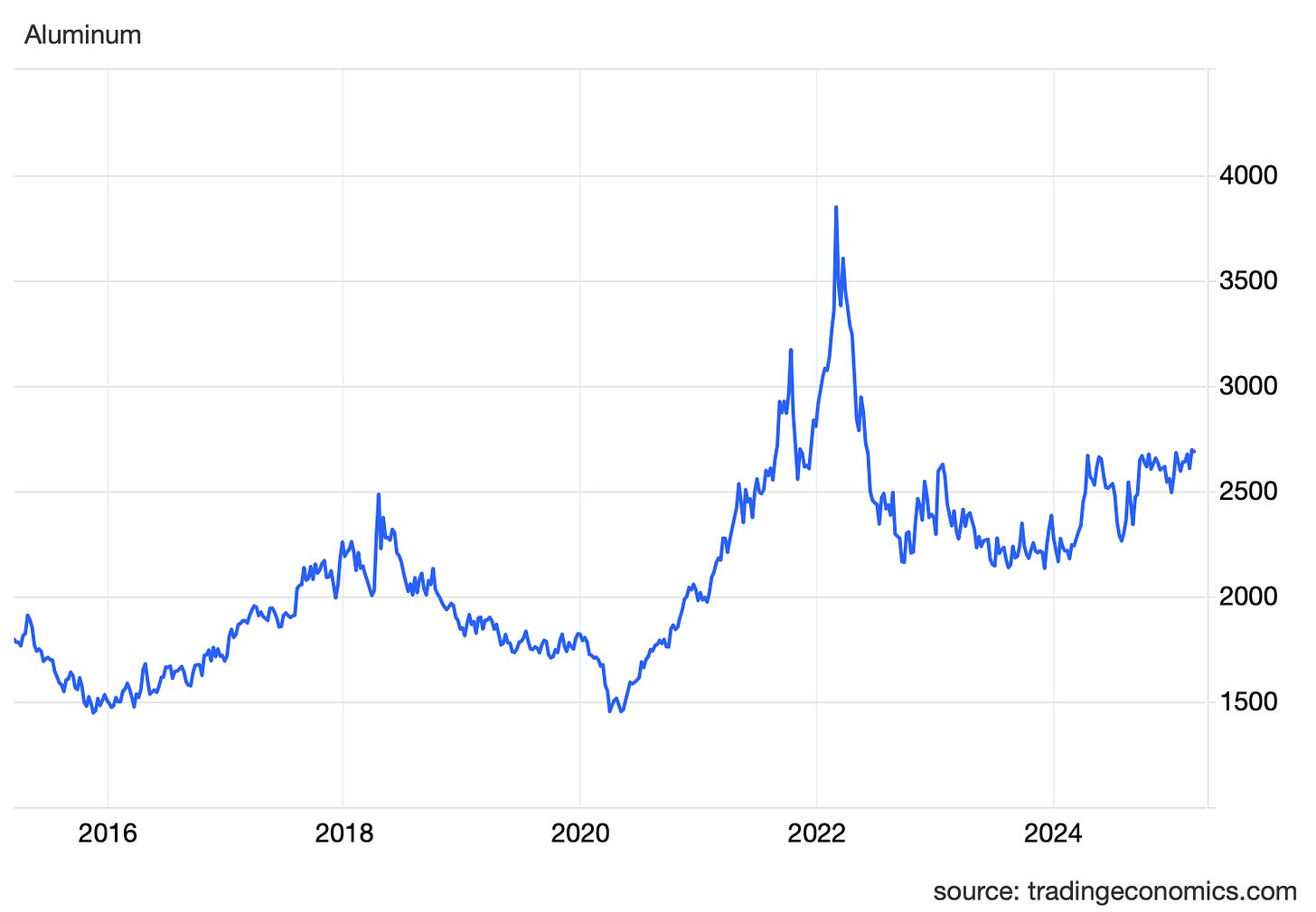

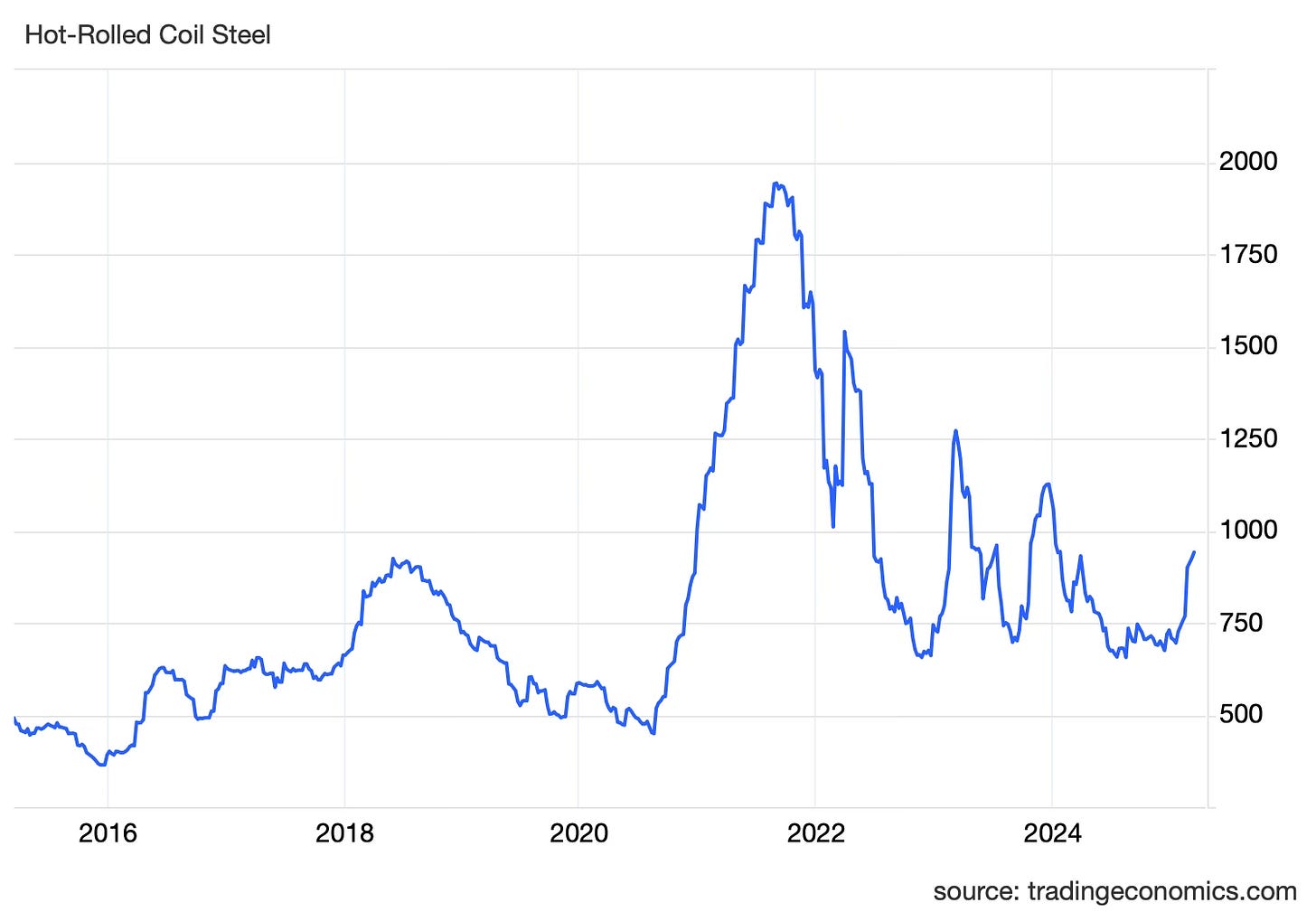

Does Aluminum Price Play a Role?

Fluctuations in aluminum prices may seem like they could significantly impact businesses that use aluminum as a primary material, but this is not necessarily the case. While changes in aluminum prices can have an indirect effect on the company, the impact is not as detrimental as it may appear. Here’s why:

First, products are typically priced based on an aluminum-plus basis, which allows the company to pass on changes in aluminum prices to its clients. As a result, even if aluminum prices increase, the company's profit margins tend to remain stable.

However, there may be indirect effects to consider. When aluminum prices rise, aluminum wheels become more expensive, making steel ones a more attractive alternative, and vice versa. Some also might think that the overall cost of cars would increase due to the rising price of wheels, but although possible it is early the case as wheels represent only a small portion of the total car value.

Second, aluminum and steel prices have historically shown a strong correlation, meaning significant discrepancies between them are rare. Even if there were a shift toward the use of one or another, the price difference would need to be both substantial and persistent, which is uncommon.

Additionally, there is a long-standing trend in which consumers and automobile manufacturers are increasingly favoring aluminum and lightweight wheels. This trend further reduces the likelihood of a short-term shift toward steel due to cost considerations.

The company's localized production in Mexico and Poland helps mitigate material cost risk by allowing it to manufacture products using local aluminum prices in North America and Poland, facilitating sales across neighboring countries.

Customer Preferences Evolve and SUP with Them

The company is well-positioned to capitalize on changing consumer preferences, particularly the increasing demand for aluminum wheels, which continue to capture market share from steel wheels each year. Additionally, there is a noticeable trend towards premium and larger diameter products. Superior, with its integrated production line and manufacturing capabilities for high-end brands like Mercedes-Benz and Lucid, is well-suited to take advantage of this shift.

This was emphasized during the last earnings call:

“Yes. So a couple of things. Let me get to your 19-inch wheel question. So the content adders in our business started with sizing of wheels and now they’re evolving very quickly to other technology, including light-weighting and finishing. So to your question on 19-inch wheels, Gary, actually, I mean, for the next call, we may just change the line of demarcation here because 19-inch wheels now is small wheels. So now we’re – the majority of our wheels are quickly becoming 20 inches or larger. So if you look at the growth in 20-inch wheels year-on-year, you’ll see a big, big movement. If you look at 22-inch wheels, you’ll see almost a doubling in the last three years.

So that trend of sizing continues. If you talk to me four years ago, would I be launching a 24-inch wheel on – for the top two OEMs in North America this year, it would be hard to believe. And we’re doing that also on other side of the ocean. So what are customers asking for? So still, the trend for larger wheels is accelerating. But now lightweighting is such a big deal, Gary, it was probably 10% of our business not too long ago. Now it’s less than 20%, but it’s accelerating very fast. It’s a big deal.” - 3Q24 Earnings

Optimizing Operations

To cut the cost and improve its margins Superior has been relocating its operations to low-cost and consumer-close destinations, specifically Mexico and Poland. Currently, the company has 30% of its production capacity in North America and 25% in low-cost European countries, namely Poland.

The subsequent shift from western Germany to eastern Poland occurred at the cost of ~$40mm but we already see a major cash flow improvement set to fully materialize in 2025. Superior Industries has mentioned $23-25mm Adj. EBITDA improvement expected from the move, ~$10mm Capex reduction. As a result, the company should be bent positive this year from the move to Poland.

Additionally, the current production capacity is significantly underutilized, with the production of c. 14mm units in 2024. We estimate the total capacity could be around 18mm.

The company has set an annual adjusted EBITDA goal of 2025 USD 160-180 million, with a forecast of sale c. 15mm units, while the total capacity is approximately 19 million units annually.

Other Turnaround Measures

Due to restructuring that began in 2024, the company has incurred costs of approximately $10mm. This has led to a reduction in its global headcount in selling, general, and administrative (SG&A) roles, as well as manufacturing overhead. As a result, the company expects to achieve annual savings of $10 to $15mm, starting from the first half of 2025, with a payback period of less than a year.

Additionally, Superior has signed several new contracts set to commence in 2025, which are projected to generate up to 1 million additional wheels annually, bringing the total to 14.9 million wheels for that year. These contracts include:

A Japanese customer for the North American market, which will require 250k wheels annually starting mid-2025.

The European aftermarket, which will need 200k wheels annually.

Volvo orders for the European market, expected to provide 1.7mm wheels over the next 3 to 5 years, increasing from approximately 350k to 550k wheels annually.

The decision of many car manufacturers to reduce their reliance on China also presents new opportunities for business deals. During the recent earnings call, management highlighted a recent development:

"We have a recent agreement from a couple of weeks ago with a customer that is entirely dependent on imports from China, who wants us to start production in a couple of months." - Q4 2024 Earnings

This trend is part of a larger movement among businesses aiming to shift portions of their supply chains away from China, which is currently facing tariffs from both the US and the EU, making it a higher-risk location. As a result, Superior is well-positioned to benefit from this shift, given its capacity and scale to fill the manufacturing gap.

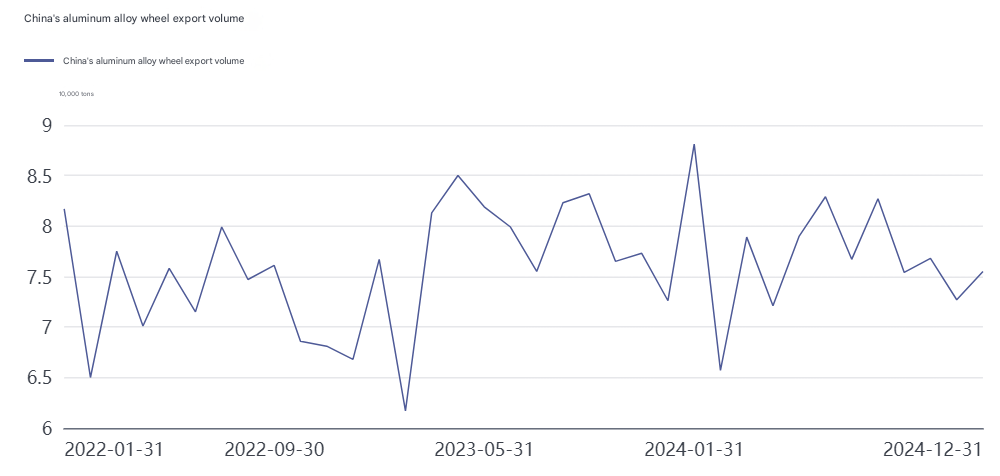

Chinese imports to the US and EU

China is the leading manufacturer and exporter of aluminum wheels. The implementation of an additional 20% tariff allows Superior to compete more effectively with relatively cheaper imports. The surge in exports following the election results indicates that these tariffs were anticipated and have impacted Chinese competitors.

According to SMM, the top five target countries for Chinese aluminum wheel exports in December were the United States, Japan, Mexico, South Korea, and Thailand. Exports to these five countries accounted for 29%, 19%, 11%, 9%, and 5% of the total aluminum wheel exports, respectively. North American countries increased their imports by 15-30% compared to November, driven by a “rush to import” in order to get goods to American shores before the tariffs were enforced.

Management — Up for the Task?

The management team has extensive experience, with several decades spent in various roles within automotive engineering, manufacturing, and management. The team consists of Abulaban Majdi (CEO), Dorah Michael (COO), and Dan Lee (CFO). You can learn more about them here. The company's track record is fairly strong, and despite a slower-than-expected integration with Uniwheels, it has been highly effective in implementing cost-cutting measures, saving millions in EBITDA annually.

While we generally dislike making excuses for the leadership team, we believe that many of the company’s challenges stem from poor timing and unfavorable macroeconomic conditions. Based on earnings calls and other events, the management appears well-spoken and competent. What is even more important is that, the leadership is aligned with shareholders, with ~35% insider ownership.

Adding Liquidity

The main problem the company is facing It’s its debt combined with narrow or negative margins. It has ~$500mm term facility due in 2028 along with $300mm preferred equity maturing in 2025. This poses a significant risk of default and illiquidity.

Debt Wall

Superior has two covenants:

Net Debt to EBITDA ceiling at 3.75x until the end of Q1 2025. After that the ratio drops to 3.5x and remains at that level. Over the last year the level was between 3x and 3.7x, currently being at a 3.38x level an our projection is that it will decline reaching 1x by end of 2028.

Minimum contractural liquidity of $37.5m in which included is USD 60m Revolving credit facility. As of 2024Y superior has USD 40.1m in cash plus USD 42.5m of unused revolving facility gives the Company c. USD 45m of available liquidity. Which we expect will grow at a USD 10-15m range barring debt repayments (which are more than likely given the terms)

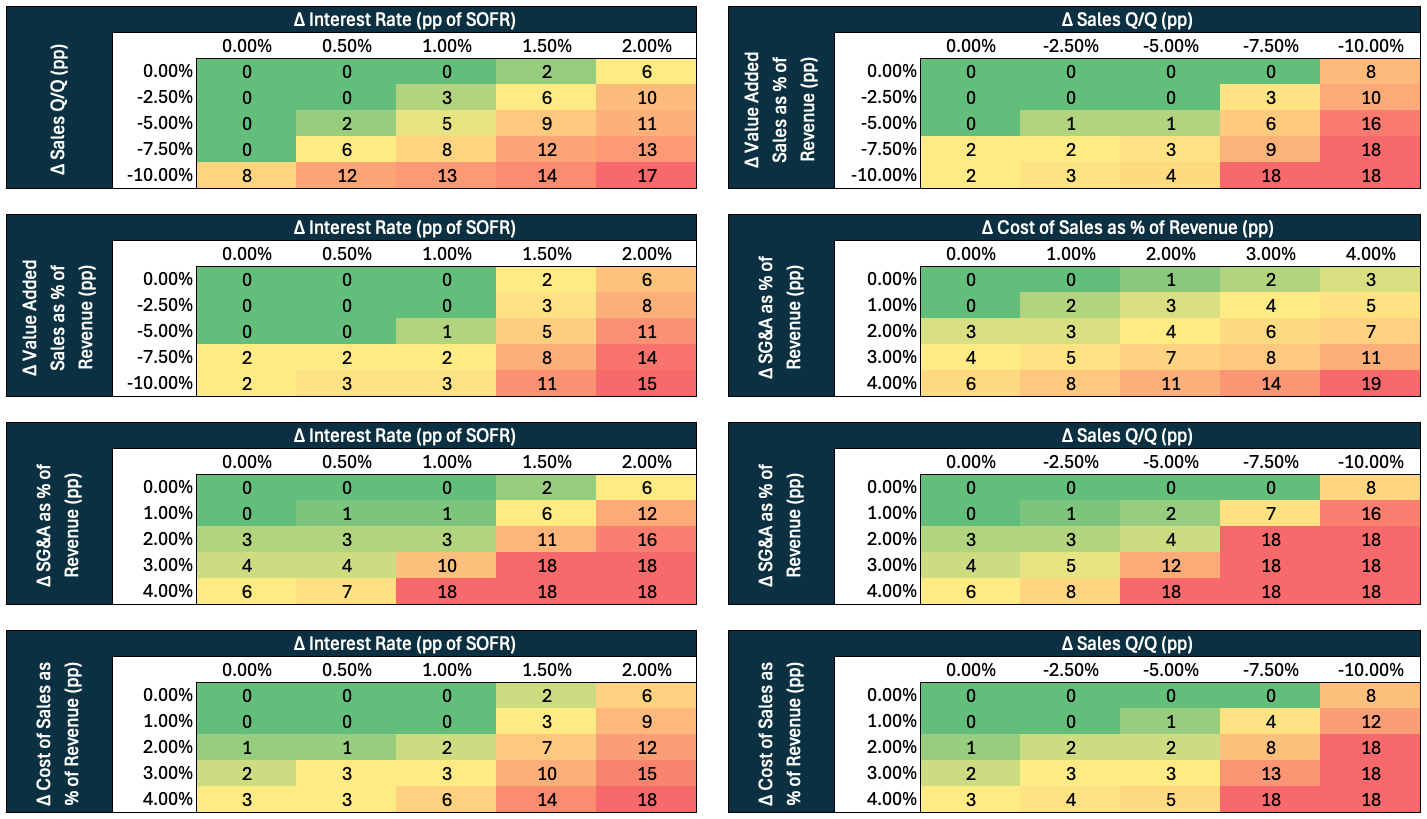

This thesis is primarily based on whether the Superior will be able to repay its debt. To analyze this, we have created several sensitivity tables to stress-test our model. These illustrate how many times a covenant is breached during the projection period from 2025 to 2028.

Specifically, if the company experiences a shortfall in the required liquidity or violates the ND/EBITDA ceiling, the sensitivity table will indicate that one covenant has been breached. If both the ND/EBITDA and liquidity requirements are violated within a single quarter, the table will show two covenants breached. Additionally, if the liquidity floor or leverage ceiling is breached multiple times, the table will reflect a number greater than two.

According to our analysis, for this thesis to hold water, there would need to be a significant increase in the SOFR rate or an unprecedented decline in business performance—both of which seem unlikely given the current macroeconomic environment and the cost-cutting measures that have been implemented.

Pay-Down Priority

In 2017 Superior issued $150mm of preferred shares with 9% interest rate payable either in cash or in kind. It can be redeemed starting from mid-September 2025 at two times initial and PIK’ed before that date. Interest is calculated from the notional which means it is preferential for the company to take its time with regards to repayment.

The new term loan docs prioritize the pay down of the term loan over the preferred, given 7.05(b)(9) mandates that cash payment to the preferred stock can only be made when the net leverage ratio is no greater than 2 to 1. So, with current leverage a bit over 3 to 1, preferred dividends will be PIK’ed. Which allows the Company to focus repaying the new refinanced 520m USD facility which is expensive at with a current interest of ~12% that can decrease to 10% if SOFR reaches 2.5%.

Regarding the potential conversion of preferred shares to common shares, we believe this option is unlikely to be executed within this year or the next two years, at a minimum. The conversion price is set at $28.16, which is ~13x the current share price, and the preferred shares accrue a 9% dividend. This situation implies that if Superior Industries starts to recover, converting at the current price would likely be one of the worst investment decisions in history.

Instead, it makes more sense to wait and observe as long as the business is improving. This way, we can consider converting at a higher price while still earning a significant 9% dividend. However, we acknowledge there is a risk of dilution in the future, which could add around 5.6mm common shares. Interestingly, this dilutes our upside potential from 12-13x (as discussed below) to approximately 9x, which is still an very attractive return.

In summary, if the business cannot pay down its debt and continues to decline, the shares may ultimately be converted, but at that point, our thesis would have already failed. Nevertheless, it is difficult to foresee Superior Industries breaking its covenants in the near future.

Multiples valuation

Our preferred way of evaluating SUP is multiple as we believe debt pay down should allow it to rerate and expanding EBITDA allow for a better valuation. Less than three years into the future (2028), we expect the company to have ~$289mm debt left ($238mm ND) to refinance along with ~$392mm of preferrers on a ~$249mm EBITDA. A relatively realistic 6x multiple in line with other market leaders in automotive supply chain gives us EV of $1,494mm and common shareholders equity value of USD 864mm implying a share price of $29.91 and ~13x today’s valuation.

DCF Results

We expect revenues to increase from $1,260mm in 2024 to $1,485 million in 2028. Additionally, the share of value-added sales is projected to grow from 54% to 63%. Coupled with further cost optimization, which we believe aligns with the company's credible projections, we anticipate an adjusted EBITDA margin on value-added sales to rise to ~25% by 2028, up from today’s margin of ~21%.

With a weighted average cost of capital (WACC) set at 8.1%, primarily due to our relatively inexpensive preferred shares, and a terminal growth rate of 0%, we calculate the enterprise value to be $1,588 million (11x the 2024 EBITDA). After accounting for debt and preferred shares totaling $784mm, this results in an equity value of $803mm, which is ~12x today’s valuation.

Risks

If market capitalization falls below USD 50mm for more than 50 consecutive days preferred shares holder has the ability to redeem all the > USD 300mm

Increased tariffs, especially targeting Mexico and not China

Preferred shares being exchanged for basic shares + debt would significantly dilute current shareholders

Further market downturn causing decreased revenues

Disclaimer

The information contained on this website is not and should not be construed as investment advice and does not purport to be and does not express any opinion as to the price at which the securities of any company may trade at any time. The information and opinions provided herein should not be taken as specific advice on the merits of any investment decision. Investors should make their own decisions regarding the prospects of any company discussed herein based on such investors’ own review of publicly available information and should not rely on the information contained herein.

The information contained on this website has been prepared based on publicly available information and proprietary research. The author does not guarantee the accuracy or completeness of the information provided in this document. All statements and expressions herein are the sole opinion of the author and are subject to change without notice.

Any projections, market outlooks or estimates herein are forward looking statements and are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. Except where otherwise indicated, the information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials.

The author, the author’s affiliates, and clients of the author’s affiliates may currently have long or short positions in the securities of certain of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). to the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the author nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. In addition, nothing presented herein shall constitute an offer to sell or the solicitation of any offer to buy any security.

External links, if any, may redirect you to a privately-owned web page or site (“site”) created, operated, and maintained by a third party, which may not be affiliated with Alpha Ark. The views and opinions expressed on the site, other than those presented by Alpha Ark, are solely those of the author of the site and should not be attributed to Alpha Ark. We have not verified the information and opinions found on the site, nor do we make any representations as to its accuracy and completeness as to the third-party information. Further, Alpha Ark does not endorse any of the third-party’s products and services or its privacy and security policies, which may differ from ours. We recommend that you review the third-party’s policies, terms, and conditions to fully understand what information may be collected and maintained as a result of your visit to this website.

Hi, this is a really well thought out article although I have 3 questions:

How has the relocation of Superior Industries' operations to Poland impacted its profitability and cash flow?

What are the key factors contributing to the decline in the total number of units produced by Superior Industries from 2019 to 2024?

What are the possible scenarios regarding the preferred shares maturity?